The myth of the “go it alone” independent community pharmacy

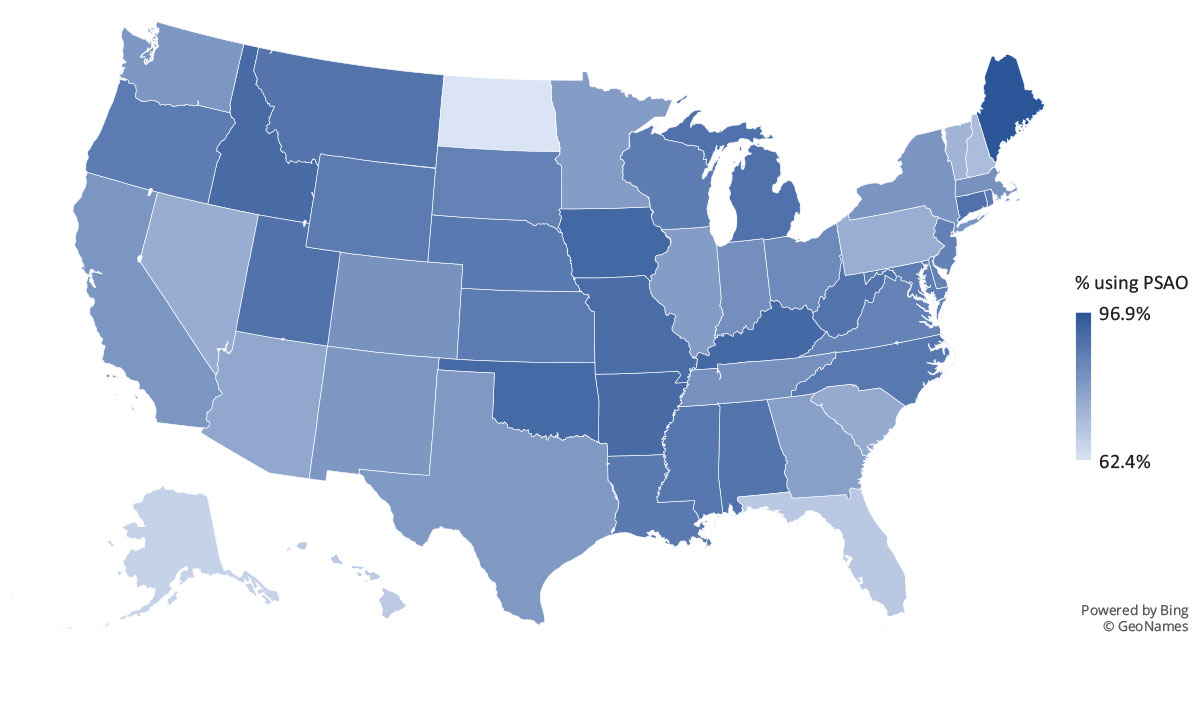

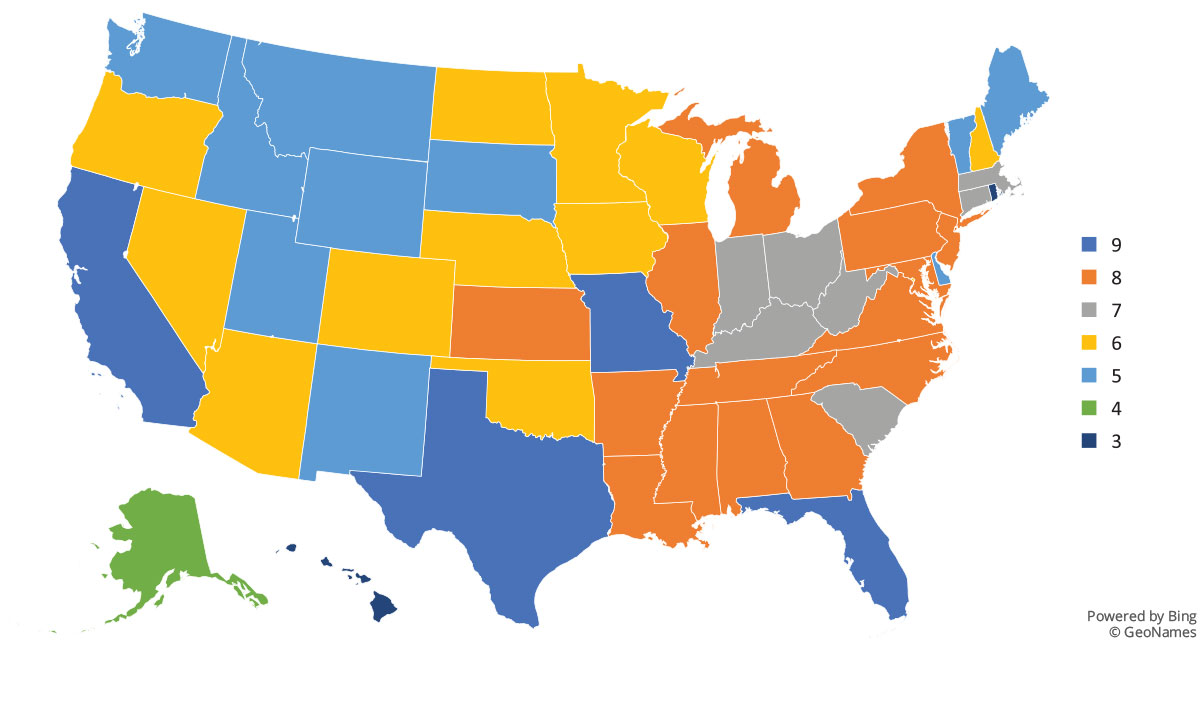

Most people believe that independent community pharmacies are individual “mom and pop” proprietorships standing alone in the face of drug manufacturers, pharmacy benefit managers (PBMs), and health plans. But the reality is most independent community pharmacies are part of little-known collective bargaining groups called pharmacy services administrative organizations (PSAOs), which leverage their membership (i.e., the pharmacies they contract with) to negotiate contracts with other parties in the pharmaceutical supply and payment chain. PSAOs also provide a wide range of business services to all types of pharmacies, which are necessary to run a successful pharmacy. PSAOs effectively stand between most independent pharmacies and the rest of the business world, including payers and PBMs. From billing support to information technology purchasing and implementation, PSAOs basically run many of the core back office operations for many pharmacies.

SEE FULL REPORT