This is the first blog post in our Fun with (Medicare) Stars series; if you haven’t read the post that describes this project, you can find it here for more context. Briefly, the goal is to explore our previous observation from the CMS Trends in Part C & D Star Rating Measure Cut Points reports that the plan-level average beneficiary adherence level has been increasing over time across four Star Ratings drug adherence metrics. Adherence metrics are a proxy to indicate that patients are taking their needed medications as prescribed.

Let’s start with the Medication Adherence for Hypertension (RAS antagonists) measure. Hypertension, more colloquially known as high blood pressure, affects an estimated 36 million American adults aged 65 and older, and treatment guidelines recommend that nearly all of them take medication to manage it. Hypertension is commonly treated with a class of drugs known as renin-angiotensin system (RAS) antagonists, which include Angiotensin-converting enzyme (ACE) inhibitors, angiotensin II receptor blockers (ARBs), and beta blockers, among others (disclaimer: I am not a clinician, and this is not medical advice).

CMS defines this measure as the “Percent of plan members with a prescription for a blood pressure medication who fill their prescription often enough to cover 80% or more of the time they are supposed to be taking the medication.” Using the CMS-established cut points for the measure, we can see that the average adherence levels for beneficiaries enrolled in 4 and 5-star plans has increased over time. Unfortunately, what we can’t see from this cut point data is how the average plan adherence level across Part D has changed over time. Have plans, on average, seen more of their beneficiaries with hypertension adherent to their RAS antagonists over time? The answer is yes!

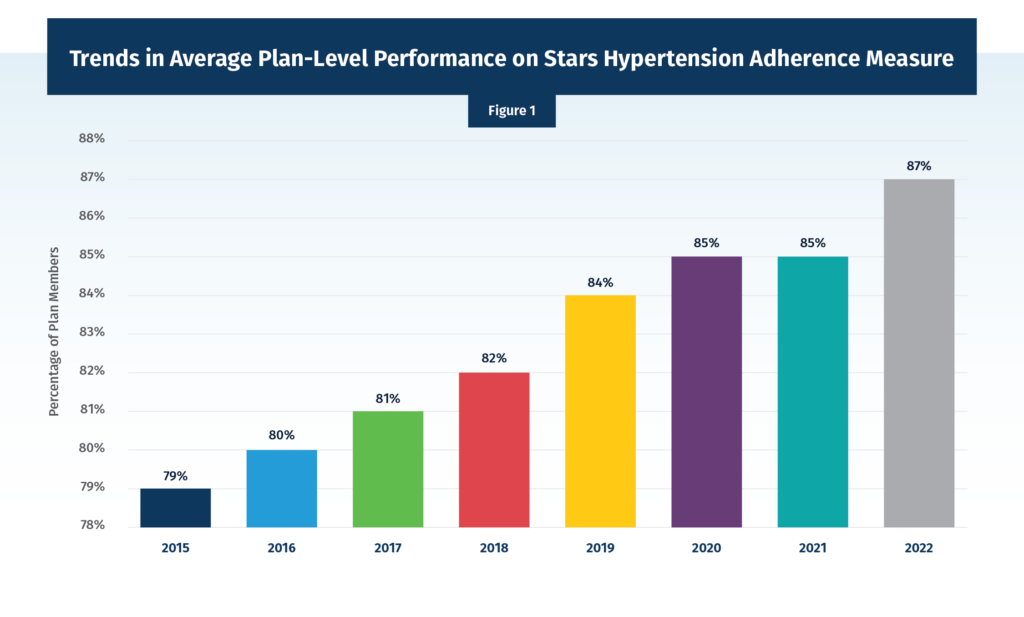

Using another dataset from CMS, which gives us more details on the measure scores for individual contracts, we can take another look at the average contract score each year across the program as a whole. Across all prescription drug plan (PDP) and Medicare Advantage prescription drug plan (MA-PD) contracts, the simple average score for beneficiary hypertension adherence has risen from 79% in 2015 to 87% in 2022, an eight-percentage point increase (Figure 1). A note on methodology: due to data lag, the data points presented are labeled for the Star Rating year and calculated using data from two years prior. For example, the 2022 Star Rating value is calculated using 2020 data.

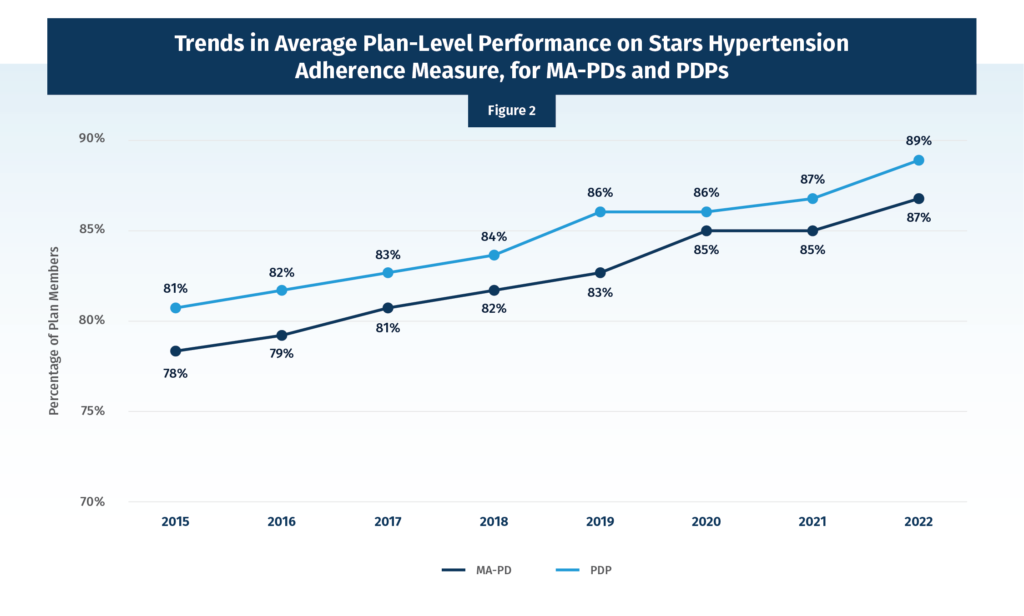

Recognizing that the averages created above combine PDPs and MA-PDs, which are very different benefit structures, Figure 2 looks at the average contract-level hypertension adherence for MA-PDs and PDPs separately. We see the same trends in both programs that we observed for the combined averages, with MA-PD slightly lower in each year.

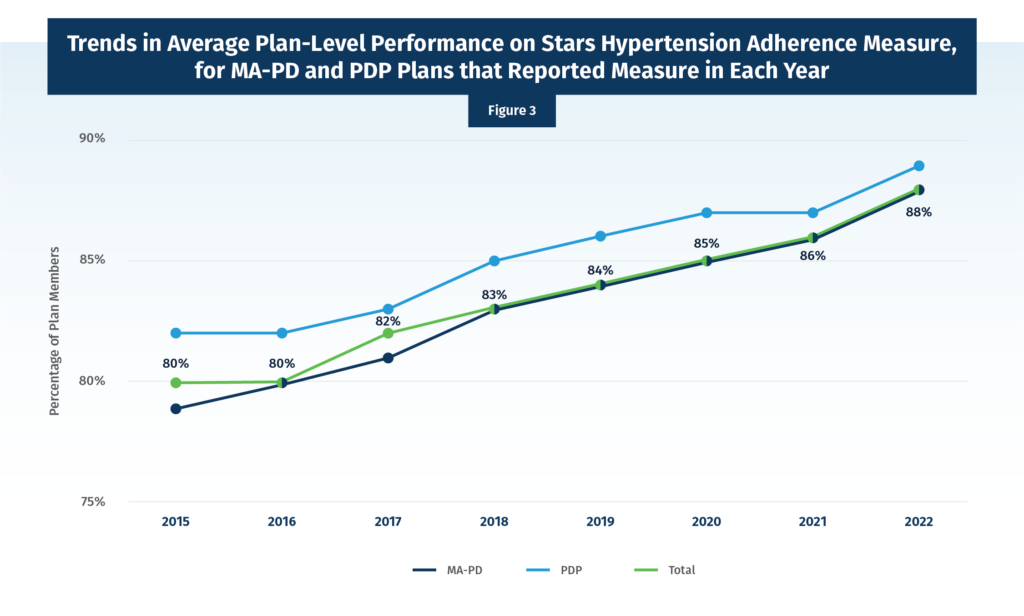

It is important to note that over time new PDP and MA-PD contracts can join the program, and a few also close. So, it is worth looking exclusively at the “stayers” or those contracts that were in place each and every year from 2015 to 2022. This look (Figure 3) again shows the same upward trend.

Any way we cut the data – we’ve shown three different presentations here, but others are possible – we see the same trend of increasing average adherence over time. To improve this Star Rating value, Medicare plan sponsors typically rely on adherence programs led by their contracted or integrated PBMs. One example of this type of arrangement is preferred pharmacy networks, in which PBMs incentivize both pharmacies (directly through value-based contracting) and beneficiaries (indirectly through reduced cost sharing when using these pharmacies) to boost adherence rates. It is relevant to note here that the use of preferred pharmacy networks in Part D has been increasing along with the average beneficiary adherence. For 2022, 98% of beneficiaries in PDPs are enrolled in a plan with a preferred pharmacy network.

And as I have previously discussed, gains in adherence translates in plain English as real people staying on their medications and having better health outcomes. Further, these PBM-contracted pharmacies serve consumers from a wide variety of plans outside of Part D, and these other patients could also benefit from pharmacy workflow changes due to the Part D-related PBM incentives that are increasing adherence at the pharmacy level. While this potential spillover effect is purely hypothetical and could serve as the subject of its own blog post, it serves to demonstrate the broad value of the Star Ratings beneficiary adherence programs. And helping patients stay on their prescription drugs is a goal that all actors in the drug payment and supply chain can align on.