Millions of Patients Impacted if Option to Use Spread Pricing is Taken Away

Pharmacy benefit companies offer employers and health plans flexibility when they’re designing their pharmacy benefits. From formularies to compensation, there are choices for employers and plans to make in the contracting process.

One of the many options for employers and health plans is to choose a spread pricing model or, said another way, a risk mitigation model. Congress is considering eliminating the option for employers and health plans to choose spread pricing. Simply put, banning spread pricing in pharmacy benefits would have a profoundly negative impact on tens of millions of patients.

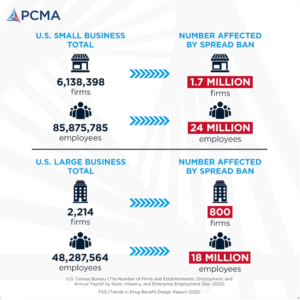

Using data from the U.S. Census Bureau and PSG Trends in Drug Benefit Design Report as the basis for analysis, we estimate that over 1.7 million small businesses would be affected by a spread pricing ban. This equates to putting at risk the prescription drug benefits of more than 24 million employees and their family members – because of a government ban on this contracting option. When you also include employees at large businesses, the number of those impacted increases to 42 million employees and their family members.

See the breakdown of how many businesses and employees would be affected by a spread ban:

Why do Employers and Health Plans Choose Spread Pricing in Contracts with PBMs?

First, it’s important to highlight that 34 percent of employers, 33 percent of labor unions, and 26 percent of health plans choose this risk-mitigation pricing model, according to a 2023 PSG survey.

Spread pricing models are called risk mitigation models for a reason. Here’s why some businesses choose to use spread pricing: Different pharmacies charge different amounts for filling the same prescription. For example, prices for a drug can vary based on whether a pharmacy is in or out of a consumer’s network or whether the pharmacy purchases more or less expensive versions of a multisource drug. To address price variation, employers or health plans may prefer that the pharmacy benefit company assume the risk when patients choose costlier pharmacies to fill their prescriptions. In a spread pricing model, the payer agrees to pay a set reimbursement for each drug to the pharmacy benefit company, regardless of which pharmacy the patient used. If the pharmacy charges the pharmacy benefit company more than the rate agreed to between the payer and the pharmacy benefit company, the pharmacy benefit company covers that difference and takes a loss. Or, if the pharmacy charges less, the pharmacy benefit company earns a margin (i.e., the spread), which it keeps as a form of compensation from the payer.

The employer or plan sponsor is guaranteed a fixed cost for a prescription drug, which provides them with financial certainty and pricing predictability.

U.S. Senator Rand Paul (R-KY) said during a recent U.S. Senate Health, Education, Labor and Pensions (HELP) Committee markup of misguided legislation targeting this option:

“This bill bans spread pricing, which small businesses and startups often choose because the PBMs take on the additional risk for themselves…This bill takes away choices. So there is a choice in the marketplace between spread pricing and pass through, every company has it. You’re going to take this choice away… Some labor unions actually like this choice… Some small businesses do. In fact, the PBMs compete on this model. The smaller PBMs absorb more risk and offer a cheaper product… Small businesses choose it on price and the smaller PBMs do it to try to take away market share from the bigger PBMs.”

__________________________________

Read PCMA’s recent blog on how pharmacy benefit companies offer choice and flexibility that allows employers to choose a benefit design that provides affordable, quality prescription drug coverage to their employees. Read more HERE.

Employers voluntarily choose to hire pharmacy benefit companies because of the flexibility and savings secured. See why HERE.

See PCMA’s guide to understanding the role and value of pharmacy benefit companies HERE.

###

PCMA is the national association representing America’s pharmacy benefit companies. Pharmacy benefit companies are working every day to secure savings, enable better health outcomes, and support access to quality prescription drug coverage for more than 275 million patients. Learn more at www.pcmanet.org