Welcome to the Pharmacy Benefit Brief. This brief is your monthly snapshot of news from America’s prescription drug supply chain including pharmacy benefit managers, independent pharmacies, and drug manufacturers.

PLEASE, JUST THE FACTS ON PHARMACY COUNTS…

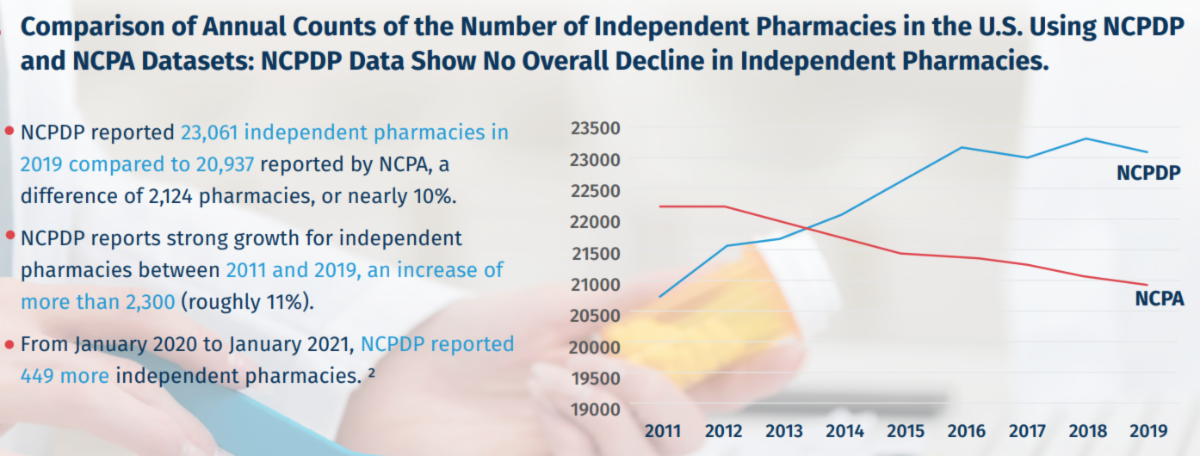

When it comes to truly understanding the number of independent pharmacies in the United States, there’s really only one data set that we can count on. A new paper by Penn State Professor Pete Hatemi explains clearly why the National Council for Prescription Drug Programs, NCPDP, is the gold standard data source on this topic.

Why is that important? There is a valid reason for having credible data, which shows that the number of independent pharmacies has increased over the past ten years. This is good news and an indicator of a strong marketplace serving consumers. The NCPDP data also shows there are many more independent pharmacies than their trade association’s data show. NCPDP is transparent about how they arrive at their numbers, while the National Community Pharmacists Association’s (NCPA’s) methodology is not explained or publicized. If independent pharmacies can convince policymakers – based on data that has not been explained – that their businesses can’t survive in the market without government intervention, policymakers are much more likely to consider legislation that ensures profits at the risk of higher costs for patients.

Good public policy should be based on a solid set of facts. Accurate and credible independent pharmacy counts are important information for the broader prescription drug pricing debate, because when onerous legislation curtails competition’s capacity to lower drug prices, then drug costs increase – and that’s not good for patients or the general public health.

DUE TO PBMs, NET DRUG PRICES FELL IN THE SECOND QUARTER…

A new analysis by SSR Health finds brand-name drug makers increased their wholesale prices by 4.4% in the second quarter of 2021. But after subtracting rebates and discounts, net prices that health plans paid for medicines dropped by 1.4% in the second quarter of 2021.

STATE Rx SPOTLIGHT: NEW YORK STATE OF MIND

A troubling but all too common situation unfolded in New York this year. Two bills that threaten to raise costs and limit access for patients passed the legislature and await Governor Kathy Hochul’s consideration.

One bill restricts convenient mail-service pharmacy, the other removes health plan sponsors’ ability to manage prescription drug formularies. For example, when a lower cost, clinically effective drug becomes available, the plan would not be allowed to substitute it onto the formulary. In addition, the legislation eliminates pharmacy accreditation standards, which help keep patients safe.

The legislation misses the mark entirely on what should be the primary objective for good public policy, which is to keep prescription drugs accessible, affordable, and safe for patients.

Often, in these situations, lawmakers are actually proposing a solution in search of a problem, which is the misapprehension that independent pharmacies are struggling and need the government to intervene. As noted in a recent column by Colin Valenta, owner of Dougherty Pharmacy in New York:

“There are more independent pharmacies in New York State than chain, grocery and box store pharmacies combined. This is likely due to the New York City region where costs for the large chain locations are not as practical as in upstate New York. Independent pharmacies continue to thrive in significant numbers in the state.”

Moreover, according to an academic analysis using the gold-standard NCPDP data, the number of independent pharmacies in New York increased 25% from 2011 to 2021. And New York is not unique; the number of independent pharmacies has increased, by close to 13%, nationwide over the last 10 years.

The bottom line is that the New York legislation, S.3762/A.1396 and S.3566/A.5854, will significantly increase prescription drug costs, restrict home delivery of medications, and remove safety protocols for dispensing medicines that protect patients.

What is a PBM? Watch the short video here.

America’s pharmacy benefit managers (PBMs). PBMs are advocates for consumers and health plans in the fight to keep prescription drugs accessible and affordable. PBMs administer prescription drug plans for 266 million Americans and have been able to achieve an overall stable cost trend for prescription drugs by innovating consumer-friendly, market-based tools that encourage competition among drug manufacturers and drugstores and incentivize consumers to take the most cost-effective, clinically appropriate medication.